Russian Assets: Your Money or Your Life?

As Western democracies apparently struggle to find internal resources to help Ukraine defeat Russian aggression, a mountain of Russian assets sits frozen in various locations

As Western democracies apparently struggle to find internal resources to help Ukraine defeat Russian aggression, a mountain of Russian assets sits frozen in various locations

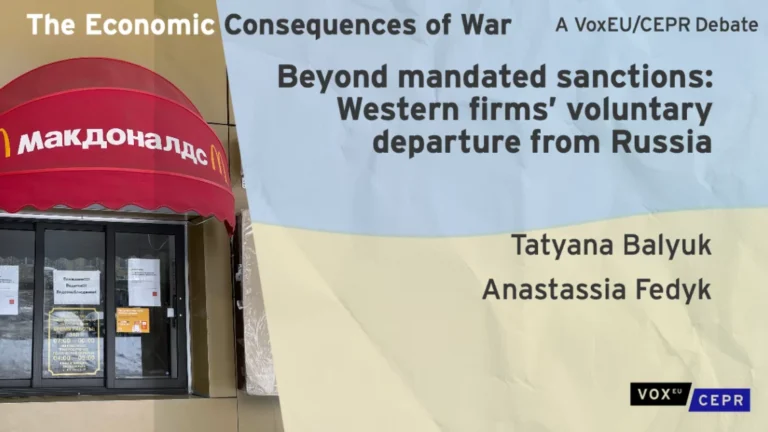

In addition to sanctions imposed on Russia by Western countries, many corporations voluntarily exited the Russian market following the invasion of Ukraine in 2022. This

Recently a representative of Putins opposition, Leonid Volkov (who resigned from chairing the Navalny fund upon the revelation of his signature under the letter calling

This eBook, which was collated in a matter of days to mark the anniversary of the Russian invasion of Ukraine, is a collection of essays

We use a unique high-frequency Russian customs data to evaluate the impact of international sanctions on Russia. We focus on Russian crude oil and oil products exports, as they are the key sources of export revenues and government finances. We find that Russia was able to redirect crude oil exports from Europe to alternative markets such as India, China, and Turkey with no loss of volumes. In particular, we find that Russian oil exports from Pacific Ocean ports, which are critical for trade with China, do not comply with the G7 price cap.

By Tania Babina, Benjamin Hilgenstock, Oleg Itskhoki, Maxim Mironov, and Elina Ribakova

To rebuild Ukraine after the war as soon as possible, one needs to сonsider key areas and approaches to reconstruction already now.

There is a risk that Ukraine’s war effort may be undermined by inadequate external support, leading to excessive reliance on monetary financing, which would drive

As the conflict in Ukraine continues on into the latter months of 2022, this book outlines macroeconomic policies to put the economy of Ukraine on